2021:9 rotation, S&P Global, "companies that happen to sell", exchanges and cork stoppers.

Time for another write-up!

I feel the speed you are moving forward varies through time. Depending on lots of things like literally your time allocation and agenda, energy level, people you talk to and things you read and listen to. As well as things you don’t read and listen to.

Even though “business models” were always at the centre of daily activities, I feel the past couple of weeks were even more skewed to that (in a good way). Questions such as: industry value chain, how does a company generate sales, what’s the cost structure like and how is management allocating capital are at the centre of this.

And even though there was a little bump in the weekly rhythm of the substack writing (which doesn’t really matter in the end) - I want to go more and more towards these kind of writings in the coming period. Not really deep dives into a certain company but just putting things together to have a continuously growing and better understanding of a certain industry. I jokingly call it “thinking out loud” sometimes - in this case writing it down silently I guess.

If anybody is interested in talking about a certain industry or company - always happy to brainstorm. In my agenda I put these as “digital coffee sessions”, guess I should come up with a better term one day. Don’t expect expert sessions - just bouncing of ideas.

The rotation in equity markets

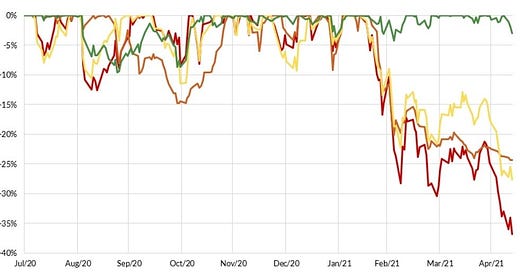

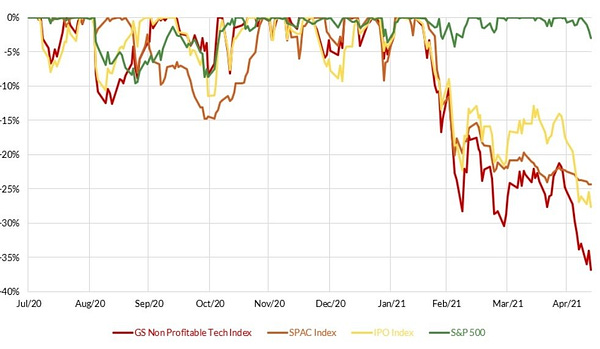

Starting with an overall observation: equity markets are slowing down a bit the last couple of days. Underneath the surface, there was already quite some rotation for a few weeks. Cyclicals like energy, materials and financials are winning YTD. High-growthish and non-profitable tech companies are in quite a drawdown since mid February:

Some 2020 IPO’s are down 50%. There are some smaller lesser know companies in this list but also big IPO’s like Airbnb (currently USD 83 billion marketcap), Snowflake (54) Doordash (37) and Palantir (34).

S&P Global

S&P Global is pretty high on the business quality and profitability rank. The company reported earnings in the last week of April. This is the business of S&P longer term:

And this was Q1 2021:

Ratings are about 50% of S&P revenue - followed by Market Intelligence (30%), Platts (15%) and Indices (15%) (numbers rounded). S&P expects global issuance to slow a bit (-2%) after two strong years. The merger with IHS is expected to close later this year.

If we would go back to 1990, gross margins have been trending up from 50% to 72%. Same goes for operating margins - which currently stand just below 50%. Quite amazing margin levels.

Demand creation expense and companies that “happen to”

Damon Ficklin - Polen Capital - appeared on the Meb Faber and Wealthtrack podcasts. In the past I also talked about the expression “Nike is a marketing company that happens to sell shoes”. I do really like the quality / looks of most of their products - but the marketing aspect is true of course. Ficklin mentions demand creation expense - a term that is literally used in the annual report of Nike.

About USD 4 billion (about 10% of sales) demand creation expense - that is what you are up against as a competitor.

Adidas doesn’t use the same terminology - but look at the employee split. About 6000 FTE’s in marketing:

And their income statement. About EUR 3 billion - % of sales lands a bit higher versus Nike.

Btw: a similar expression works for Domino’s Pizza - which is a logistics company that happens to deliver pizza.

I also saw this snippet passing by on Twitter:

Business model resources

I feel more and more good quality business model content is floating around these days on the internet (or I might be looking for it more than before). Twitter, substack and the internet in general has probably something to do with it. This includes some deep dive substack writers (some of them are behind a paywall).

Guess everybody knows the joincolossus.com website/podcast by know. I really like the content of Ensemble Capital - recently they talked about Home Depot and Fastenal during their quarterly call (and they nicely separated these two talks on their blog).

With regard to Home Depot: this is an intriguing stat:

While the company does not report on their contractor business separately from their homeowner business, they have regularly offered comments indicating that contractors make up just 4% of their customer base, but about 45% of revenue. Basic math implies that this means the average contractor customer spends about twenty times the amount that the average homeowner customer spends. In an industry where you want to drive high levels of sales per store, the contractor customer profile is super attractive. It is Home Depot’s focus on and success in serving contractors that has led to them generating about 30% more revenue per store than competitor Lowe’s which has far fewer professional contractor customers.

And one for Fastenal: of course there was growth in safety supplies - the important point imo is Fastenal quickly found extra suppliers in 2020:

It’s instructive to see how Fastenal was able to procure safety supplies to accommodate such a huge spike in growth of over 100% in the second quarter of 2020 when everyone else was also scrambling to source materials in short supply. In its latest annual report, the company published an interesting chart that really speaks to its sourcing agility, scale, and expertise: while 80% of safety supplies were provided by existing primary suppliers in 2019, they only accounted for 40% of the total in 2020. Since safety supplies sales grew 50% y/y in 2020, Fastenal was not only able to source new suppliers for the incremental growth but also backfill shortfalls its primary suppliers had during the year.

I also like to read these threads on twitter:

Stock exchanges

Last couple of weeks, I did some digging into the London Stock Exchange (and especially the Refinitiv deal). Stock exchanges:

performed pretty good the last couple of years (especially within the financials sector versus banks and some insurers) - and more than once pop-up in “quality” portfolios

are much more than exchanges - and more a mix of data, index and clearinghouses - this also means they compete with a bigger set of companies (e.g. pure play index companies like MSCI and data companies like S&P Global)

Some snapshots from the bigger exchanges below.

70% data & analytics = Refinitiv, Enterprise, FTSE/Russell,…

15% capital markets = LSE, Tradeweb and FX

15% post trade = LCH

I guess the jury is still out how good management can execute/integrate and how the Refinitiv platform will perform going forward. In order to get the deal approved, Borsa Italiana was sold to Euronext (for EUR 4.4 billion).

Most exchanges stress their % of recurring revenue - which is 80% for LSE.

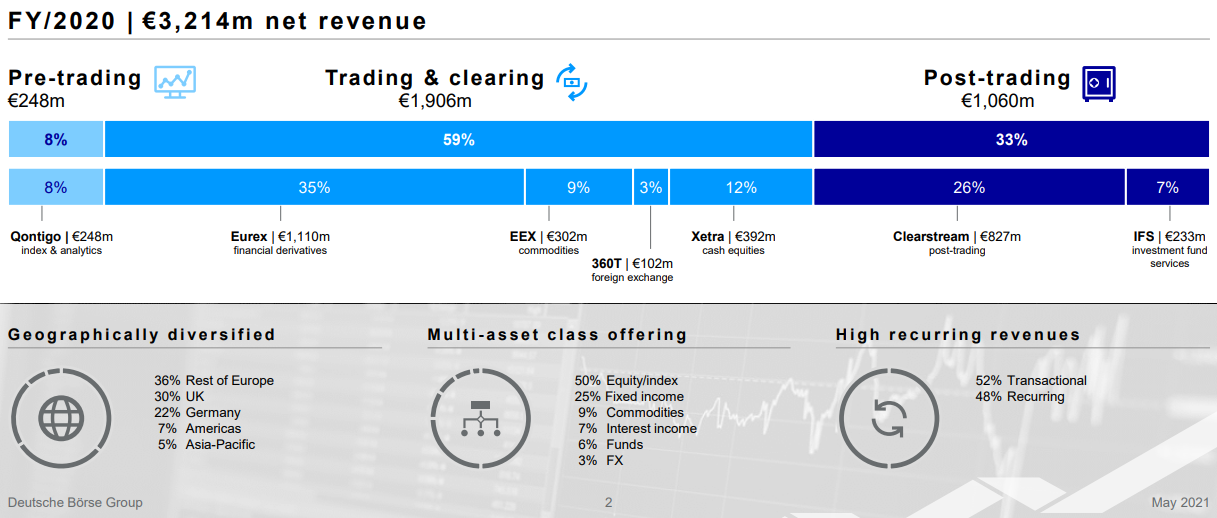

60% trading & clearing: Eurex, EEX, 360T and clearing

33% post trade: Clearstream (competitor of Euroclear which is owned by a consortium) and IFS (Vestima)

8% Qontigo: Dax/Stoxx indices and Axioma risk

CME doesn’t seem to publish an investor overview presentation. Let’s say CME is one of the “purest” exchanges (and clearing) for derivatives linked to rates, equity indices, forex and commodities. Per Morningstar:

More than 95% of US interest rate futures trade on CME’s exchange, the company has exclusive licenses to issue future contracts on the S&P 500, Russell 2000 and Nasdaq indexes, and the company is the dominant venue for trading WTI oil futures.

Because of rate and commodity future (volume) exposure, some consider CME as an inflation hedge (in the loose sense of the word of course).

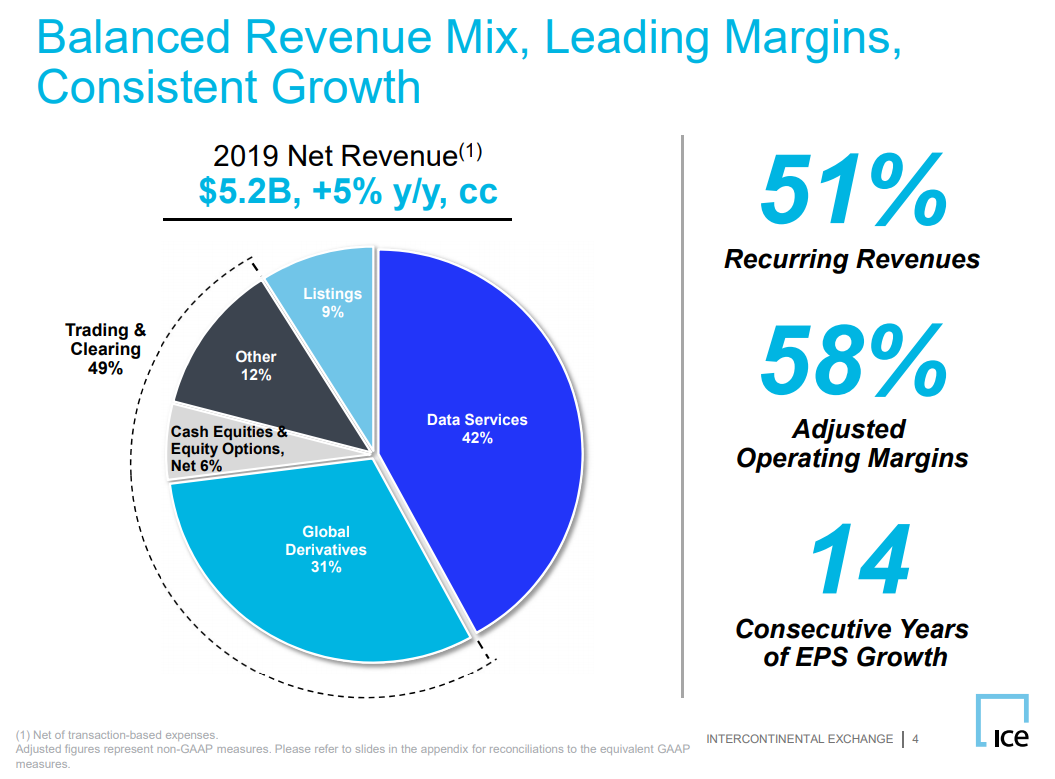

ICE investor presentation reads more like LSE and Deutsche: the words data and recurring pop-up more than once and the company is

50% trading & clearing: 95% global CDS cleared, 24% US cash equity market share, equity and rate derivatives

42% data services: pricing data, indices and feeds

9% listings

And there are others of course such as:

Euronext is one of the smaller publicly quoted exchanges (EUR 6 billion marketcap) and is a diversified player active in data, trading and post-trade services. They acquired Borsa Italiana (see LSE).

Hong Kong Stock Exchange (HKEx) basically has a monopoly in Hong-Kong (versus for example the US where there are multiple exchanges - you also see this in the margin level of HKEx). HKEx acquired the London Metal Exchange (LME) in 2021. They are also involved in the Shanghai and Shenzen Stock Connect.

CBOE Holdings mainly know for options (S&P and VIX) but also active in cash equities, futures and FX.

Cork stoppers

A funny note to end. If you would ever drive through the Alentejo region in Portugal, pay attention to the cork trees. Also: if you would drink some rosé (or any other) wine in the coming summer, chances are the cork stopper is coming from Amorim - one of the worlds leading cork producers. The company is publicly traded - but small with only EUR 1.3 billion marketcap and 30% free float.

ESG investors - or at least the “E” investors - should love this product:

Cork and Climate Change

Harvesting cork bark assists in the absorption of CO2 – a greenhouse gas that causes climate change. In fact, harvested cork trees absorb 3-5 times more CO2 than non-harvested trees. Cork oak trees in Portugal alone help offset 10 million tons of carbon every year. Cork trees are also important producers of oxygen.

Cork Trees Are Harvested, Not Cut Down

Cork stoppers are made from the bark of a cork oak tree, not the tree itself. Bark is harvested from the tree every 9-12 years. Completely renewable and sustainable, harvesting bark does not harm the tree. Each time cork is harvested; cork bark regenerates itself (and in doing so absorbs CO2). In fact, cork trees live between 100 and 300 years.

Amorim - the Portugese company - exists already for 150 years.

Enjoy!