2021:6 Inflation, Fundsmith, Tepper, intangibles and Octahedron Q4 slidedeck

Some thoughts on inflation. Fundsmith and Tepper talking about their positioning. A nice intangibles talk and Octahedron Q4 slidedeck.

Enjoy!

Inflation seems to be a headline risk now. This means:

a lot inflation specialist wake up - also wannabee specialist like myself who just like to think about these topics ;)

probably another risk - one which we don’t see / notice yet - shows up in the end and triggers a sell-off (or rally)

One of the often heard arguments is the growth in the current fiscal support and money supply. There are different ways of looking at it but simply dividing money supply by GDP gives one impression of the recent rise of liquidity in the system. Let’s just agree money supply grew faster than GDP the recent period.

Money in the system does not mean of course there will be inflation. Currently there is probably some sort of asset inflation (i.e. money “chasing” assets such as equities). However, people are of course worried about the fact there is a potential set-up for higher inflation the coming period:

household saving rates are high

there is pent-up demand for certain services like holidays

there might be some supply constraints (in the short term)

commodity prices are on the rise

…

Saw this visualisation of the American savings rate passing by:

And this with regard to excess savings - worldwide (if the USD 1.9 trillion US stimulus is finalized - the US might have another leg up in household income):

Inflation is - imo at least - a complex datapoint and issue overall with lots of arguments to take into account such as:

inflation expectations remain fairly moderate (doesn’t mean the market can’t be wrong of course)

unemployment is still fairly high (but could come down quickly)

there is still excess capacity overall (same)

economy will reopen depending on vaccination progress and the consumer is healthy with pent-up demand

markets don’t really price in higher rates for the coming period - central banks might wait to raise rates until they literally see some inflation

And next - if we would know inflation - how are central bankers going to react? how are markets going to react? will it be a temporary bump in inflation? Like Terry Smith of Fundsmith started his annual meeting: if you would have the newspaper one year in advance - it is not that valuable: you need the stock market page (i.e. how markets are going to react).

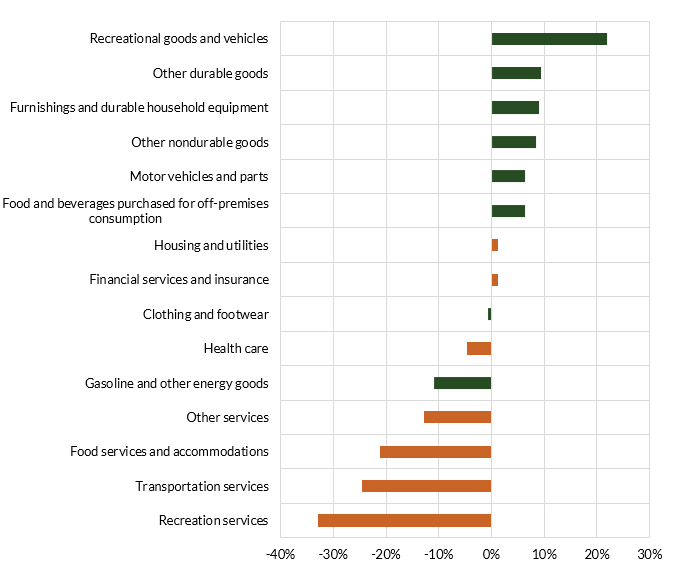

I prefer to make it more concrete by looking at different components of Personal Consumption Expenditure (PCE). As usual - the US has quite clean data on this. One intriguing development is the divergence between good and services in terms of expenditures (services being about 60-65% of PCE) during the pandemic:

Although looking at the different components - it does make sense of course. If we look at Q4 2020 versus Q4 2019 numbers for things like recreation and food services, they were down more than 20%. Furnishing and recreational goods were up resp. 10% and 20%. Basically: people have been buying a new dining table - but of could not travel or eat out.

Total consumer expenditure is about 70% of the US economy so yes the consumer will drive GDP growth (travel, eating out, transport,… is about 15% overall economy) - especially given the consumer seems to be in good financial health on average. Of course there will also be a rebalance: we can’t keep buying dining tables (I guess).

Last week enjoyed two good publications with regard to inflation. One of BCA and one of JPM with regard to the state of the consumer. Also: the writing of Jesse Livermore: it’s a deep dig - but it is really good if you want to create an overall picture and historical framework.

To finish - I’m a business model (micro) guy some in the end concerned about how companies will handle (potential) inflation in terms of input prices such as labor and commodities.

With regard to minimum wage: this is an important point imo:

Fundsmith published their annual meeting. A bit of British humor mixed with finance is always a good thing:

Let’s say I almost never listen to something like CNBC (or Bloomberg for that matter) - but guess anybody tunes in when investors like Tepper share their opinion:

The thing is: you don’t know their positioning or their horizon. As long as you realize that - all good.

I liked this talk on intangibles. Lev Baruch is the author of the End of Accounting.

Some remarks might sound basic - but given the importance of intangibles and the difficulty to capture it / put a framework on it - everything helps and repetition doesn’t hurt! Three important takeaways (with regard to intangibles in general):

do realize the world (economy, business and consumers) has changed over the years

think about the business model — valuation of intangibles is inherently quite difficult

you can of course try to adjust certain P&L or Balance Sheet items - you can for example capitalize R&D (adjusted operating income is operating income + current year’s R&D expense - amortization of the asset) or capitalize operating expenses (where you have to take an assumption how much of SG&A is related to brand, training of employees, etc.) ~ check Damadoran (+ intangibles) to get lots of free material on this

External sources like Interbrand can also serve as an extra datapoint (again: when you find somebody who can exactly value the Apple “brand”: call me - it is more of a guesstimate and/or extra input).

When writing this - I bumped into a PWC accounting podcast - don’t know whether that is too goofy or not ;)

Again: I feel business model should come first and be the biggest element of your overall process. Valuation or accounting shouldn’t be neglected of course and in times of volatility it can also provide some extra perspective away from everyday markets.

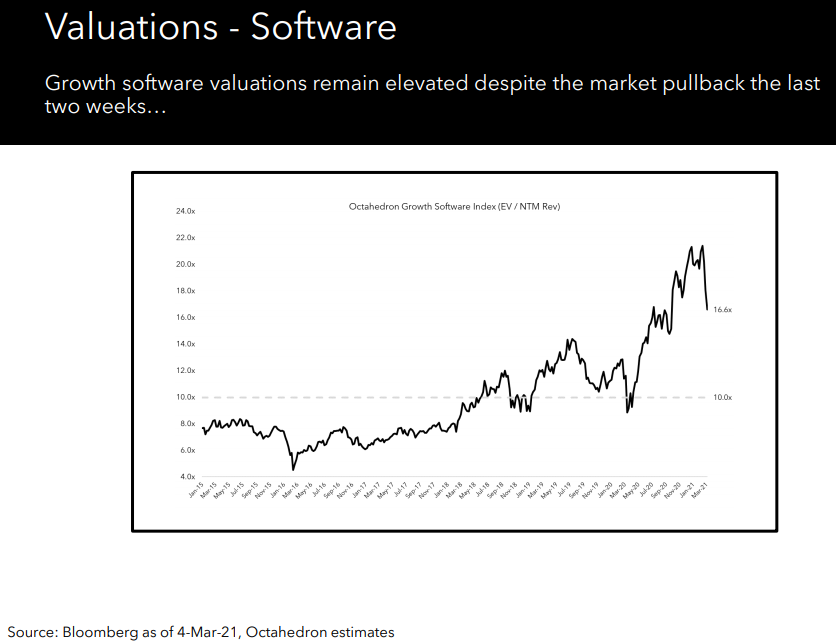

Octahedron published a new slidedeck - always a nice set to browse through.

I feel the first two slides are something where some people are struggling with now. High growth / tech stocks retreated from their mid February highs. But they also had a spectacular 2020 and a good start of the year - so they are not suddenly “cheap” (especially not on “conventional” metrics). Prices have come down of course - but if you had troubles putting together the future of a certain high growth tech company (business model, cash-flow,…wise) a few weeks ago - guess you have the same troubles today (and a 20% price decline won’t solve that for you).

This being said: Unity is 40% off ;)

Curious to see how food delivery will move along in the next couple of reopening quarters:

AWS remains the biggest one in cloud - with Google Cloud growing fast (of a low base):

Enjoy and feel free to reach out!